How to solve housing (un)affordability - Part 2 - Build. More. Housing.

To stabilise the property market, Australia needs to focus on drastically increasing the total quantity of housing being built.

It seems I am incapable of brevity, so this article is part two of what will be a three-part series of policy proposals entitled How to solve housing (un)affordability. You can read Part 1 - Legalise “The Missing Middle” here.

Everything in this post is intended as a response to the problems identified in my initial article on this topic, Australian housing culture is incompatible with rapid urbanisation. So if you haven't read that yet, please go and do that now.

On balance, having sustained levels of high population growth is a really good thing for Australia and comes with so many benefits. High net migration offsets our low birth rate, so we can hopefully avoid the very-serious ageing population problems we see facing Japan today. Having a consistent base of young people to support our steadily-accumulating horde of elderly is one of the most important things that we can do for our future.

In this way, Australia remains both The Lucky Country and The Complacent Country, in that the biggest problems facing our cities today are of our own making. We just need to treat the challenge of housing people as the very serious problem that it actually is - and not wait until things start to get dystopian before we get our act together.

Build. More. Housing.

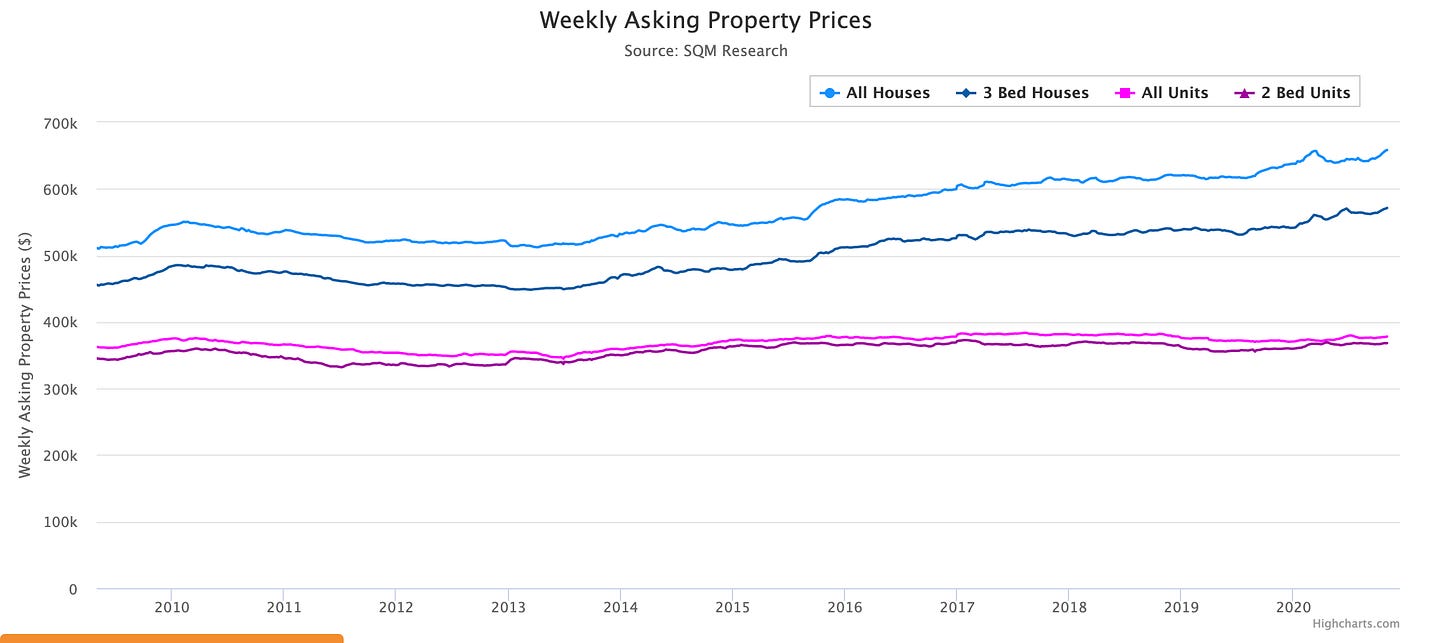

To put it very simply, we need to build a lot more housing. Right now, we are not meeting demand in a way that corresponds with population growth. Some estimate that Australia will need to increase the number of homes it builds each year by 20%, just to avoid compounding the existing affordability issues we already face.

So just to be clear - if you're unhappy with with the cost of housing in Australia right now, we need to increase the number of homes we build each year by 20% just to maintain the really bad situation we already have. Big sigh.

So we don’t just need more affordable housing (whatever that even means), Australia needs to focus on drastically increasing the total quantity of housing being built.

Building more housing does stabilise prices and rents

Before I get into it, I’ve seen the argument floating around that building more market-rate housing doesn’t actually impact property prices and/or reduce rents.

In certain circles, the idea that building more housing has any stabilising effect on rent or prices gets laughingly-dismissed as developer propaganda, bamboozling the unwitting public with economic fairy tales about supply and demand.

This is deeply upsetting to me, because if true, I am currently wasting my weekends shilling for developers that don’t even appreciate me.

In the interest of not plagiarising someone far smarter than me and a desire to not spend an entire article making a single point - check out the best takedown of the best version of that argument I’ve seen, by economist, Noah Smith. Through referencing empirical studies, Smith piles up the evidence that:

Building new market-rate housing results in a 1% decrease in rent for every 10% increase in housing stock, while sale prices also decrease in close proximity

Rents fall by 2% for sites within 100m of new construction, while renters’ risk of being displaced to a lower-income neighbourhood falls by 17%.

New buildings decrease nearby rents by 5 to 7 percent relative to locations slightly farther away or developed later

New construction reduces demand and loosens the housing market in low and middle-income areas

Smith is careful to note that the complex web of circumstances facing every city are different, so these effects will not be identical everywhere at all times - but generally speaking, the evidence points to the following sequence of events:

New market-rate housing gets built,

New residents move into the new market-rate housing,

Surrounding rents and prices either stabilise or go down.

This happened with apartments in Brisbane

If you need more receipts, Australians need look no further than our own back yard. From around 2013, Brisbane (the greatest city in the world), saw a boom in apartment construction across ageing industrial areas in inner city suburbs like South Brisbane, West End and Newstead.

The apartment boom had such an impact, that buying an apartment in Brisbane as an investment property has since become a bad idea. I personally know at least 5 people who bought apartments during that time and in every case, nearly a decade later they are worth roughly the same as (or less than!) what they paid for them.

This effect did not spill over into housing, as a block of land is a fundamentally different purchase, in that land is a finite resource, while the population keeps increasing. However - it’s a nice little microcosm of the oft-maligned “economic fairy tale” at work - a drastic increase in supply can (and did) stabilise apartment prices and apartment rents.

Now that’s out of the way, let’s build more housing.

Keep reading with a 7-day free trial

Subscribe to The Emergent City to keep reading this post and get 7 days of free access to the full post archives.