How to solve housing (un)affordability - Part 3 - "De-Investify" housing

What if our houses were just our homes?

Apologies for my neglect. Since my last post, I have fathered the most beautiful baby girl who has cured me of my need to express myself - very liberating! I’m also down about 30 IQ points (also very liberating). She's 19 months old now, and I'd hate for her to get so old that she is capable of understanding that I'm using her as an excuse for not writing - so here I am, significantly diminished and better late than never.

This article is the final part of a three-part series of policy proposals entitled How to solve housing (un)affordability. Parts 1 and 2 are focused on increasing the supply of housing, with this final article focused on reducing the demand for housing - bringing the series to a much-needed close.

Everything in this series is intended as a response to the problems identified in my initial article on this topic, Australian housing culture is incompatible with rapid urbanisation. So if you haven't read that yet, please go and do that now. It sounds dry, but it’s actually a fun read!

Housing affordability is a Wicked Problem

When I embarked on writing this housing affordability series after being “activated” by the vampire-ridden process of buying a house, I thought to myself, "Enough is enough, I'm gonna get to bottom of this". The arrogance! I planned to handle it in a single brilliant article, that has since turned into three rather tedious articles over two years. I've also managed to raise more questions than I've answered. This is because the housing crisis is a Wicked Problem ©.

What do I mean by Wicked Problem? Why is the W and P capitalised? Well, when I'm out in the world, I get the sense that people think housing affordability is like the Death Star - where all you have to do is shoot your Bill Shorten Laser at the Negative Gearing Reactor and the whole thing explodes in exactly the way you want it to. Ewoks rejoice. Medallions are issued. Credits Roll. Working class Australians once again languish in the inner suburban estates of our forebears.

In reality, the housing crisis is much more like a malignant tumour wrapped around Australia's throat, with its veins and tendrils reaching into all our major organs and delicate areas. It requires bold, multi-pronged and heavy-handed solutions to even make a dent in what is an incredibly annoying issue.

The housing crisis is a Wicked Problem, because the solution is not just one thing. The issue needs to be attacked from every angle to fundamentally change the way the Australian economy is structured, and make it stronger in long term.

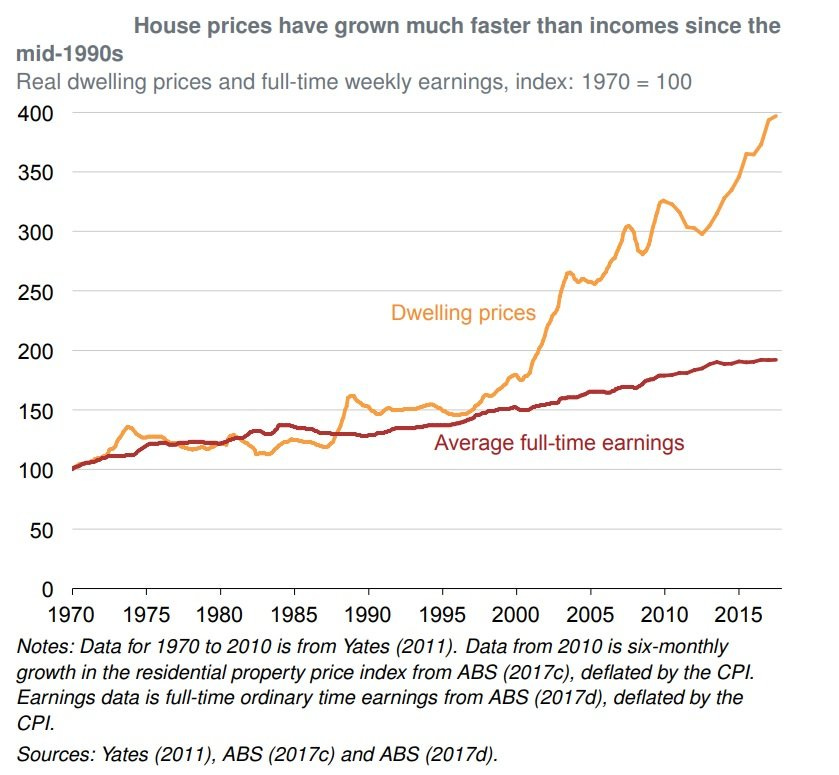

And in our long term, there really is no choice - because these problems are becoming worse, not better. Beyond a yet-to-be-determined tipping point, house prices cannot completely be decoupled from wage growth, without frog-boiling towards a kind of neo-feudal hellscape where housing becomes an increasingly unbearable burden that diminishes all other aspects of our lives.

A house is more than just a home

The problem with housing is that it isn't just how Australians stay out of the rain, it's also how we fund retirement and grow our wealth. Housing has this deviously interdependent nature where it's simultaneously:

The repository of the entire nation's collective wealth;

The largest user of land in our cities; and,

How we stay out of the rain and experience serenity.

The resulting incentive structure creates the self-perpetuating anti-social doom loop we’ve come to know and love.

Increasing supply is not enough -

we need to “De-Investify” housing to reduce demand

The Australian economy is laden with incentives that artificially boost the demand for housing.

Consider the fact that housing is the only kind of asset that banks will let you finance on 30 year terms with incredibly low interest and no margin calls. Add in the ability to dip into super for deposits, land tax exemptions, government grants, negative gearing, capital gains tax discounts - the game is rigged as they say. The board is tilted in such a way that the wealth of the nation cannot help but pour itself into the housing market.

Under this paradigm, increasing the supply of housing alone is not be enough to stabilise house prices. More supply in isolation will just result in more slop in the trough for those who are financially and politically positioned to invest.

My central claim here is that these artificial demand drivers must be surgically cut out of the economy, so that less of Australia's wealth is lured into property via these incentives. I want Australian property to be closer to its real value and not its speculative value.

So! I want to coin a somewhat silly new term that I think best describes what I'm trying to say here:

We need to "De-Investify" housing in order to extract the artificial demand from the market.

Not to be confused with the more radical idea of Decommodification which as far as I can tell, is shorthand for things like land reform, community land trusts and rent control (Communism?).

Instead, this article is me brainstorming ways to get closer to a world where we buy houses more because they are a place to live, and less so as the main way to fund retirement.

Disclaimer:

Housing will always to some extent function as a speculative asset because of the scarcity of land vs population growth vs inflation. But that doesn’t mean the growth rate can’t be stabilised, so that over time we get closer to that real value.

So! Brace yourself for my least-informed article yet. I am quite frankly out of my depth here - where I am wrong, please tell me why. I want to learn.

How to De-Investify housing

To define my silly new term:

To De-Investify (verb) Housing, is to remove or weaken the policies and

incentives that artificially boost housing's desirability as an investment asset.

Here's a bunch of ideas on what that could involve:

Keep reading with a 7-day free trial

Subscribe to The Emergent City to keep reading this post and get 7 days of free access to the full post archives.